- Education

- About Forex

- How to Trade Forex for Beginners

How to Trade Forex for Beginners

An investment boom swept the world with the advent of online forex trading, and spread to almost all financial markets and made the profession of a trader one of the most sought after.

For beginners, the question arose as to how to trade on the forex market, which is the most accessible and highly liquid; Forex daily turnover is about $6 trillion, which exceeds the volume of trading on all world stock exchanges combined.

Forex Trading Steps

So, you have decided to try your hand at such an interesting and potentially profitable craft as trading. But you still do not know where to start your work, how to go from a beginner to an accomplished trader with a minimum of financial losses and a maximum of experience gained. Then you have come to the right place, because why go through the rake when others have already done it before you.

We want to provide you with a step-by-step action plan, following which you will become a seasoned professional, of course, not without practice.

- Learn what is Forex Market

- Select Currency Pair to Trade

- Use Our Experts’ Analysis

- Open Trading Account

- Choose Trading Platform

- Choose Forex Trading Strategy

- Know When to Buy and Sell

First of all, start by understanding what the forex market is, select a currency pair to trade and study it, you can also turn to professional expert analysts. When you are already confident in your choice, you can open an account, choose a trading terminal, which is also very important, and then start trading with a forex trading strategy that you have developed based on your inclinations and character. Last but not least, learn when to buy and sell.

Let's get started

1. Learn what is Forex Market

The Forex market is an interbank market that was formed in 1971, when international trade moved from fixed to floating exchange rates. The main principle in Forex is to exchange one currency for another. At the same time, the rate of one currency relative to another is determined very simply: by supply and demand - an exchange that both parties agree to.

The foreign exchange market consists of two main components: the exchange trading market and the over-the-counter foreign exchange market, which is actually an interbank one. It accounts for the bulk of operations carried out on FOREX. This market is larger than all the others.

The daily volume of transactions in the Forex market is estimated at 1-3 trillion dollars a day, and this amounts to one to three annual US budgets. For comparison: the daily turnover of the American stock exchange is 300 billion dollars, the stock market - 10 billion dollars. It takes six months for the New York Stock Exchange to reach the daily turnover of the foreign exchange market.

2. Select Currency Pair to Trade

Choose currency pair - Once you've decided on a platform, it's time to choose what you want to trade. Volatility and liquidity are two elements that Forex traders need to actively participate in the Forex market. If you want to know “What is Forex Market” go via this link.

Note: when choosing what to invest in, consider asset liquidity, volatility and trading volume.

The liquidity of an asset is a measure of how easily an asset can be converted into cash without affecting its price. The price of a currency pair can change when a trader executes a trade and an exchange executes an order. The difference between these prices is slippage, and in the currency markets, a few minutes can mean the difference between a big profit or a big loss.

A lack of liquidity can be disastrous for the entire currency market, causing slippage and increasing the risk of an instant collapse. Traders proactively try to close their positions as soon as possible, and in the absence of buy orders, the price of an asset can plummet.

3. Use Our Experts’ Analysis

Our specialists analyze the Forex markets on a daily basis, and the thoroughness of its conduct is a guarantee of the success of players using the information provided by our specialists. There are a number analytical materials you can take a dip in, such as:

- Technical Analysis

- Market Sentiment

- Top Trades

- Top Gainers/Losers

- Market Overview

- Trading Idea

- Market Movers

- etc.

4. Open Trading Account

First things first

Open a trading Account - Unless you already own one, you’ll need to open an account, for example with IFC Markets.

To make an account, you’ll need to provide the brokerage company of your choice with personal identification information, similarly to opening an account with a stock brokerage. Some common information you need to provide when setting up your account includes your Social Security number, address, date of birth and email address.

Obviously, fund your account - Once you have signed up with a brokerage company, you need to connect your bank account. Most brokers offer bank financing through debit cards and wire transfers. Bank transfer is usually the cheapest way to fund your account.

Choose trading platform to trade on - The first choice is not always the best choice when figuring out where to trade Forex. For aspiring traders, the options and differences between many exchanges can be overwhelming.

Here are the main points to consider when choosing the right trading platform:

- Years of activity - the longer the exchange works, the more chances it has for stability and trust.

- Fees - transaction fees are what exchanges charge when buyers or sellers make a trade. All Forex exchanges charge users a transaction fee to monetize their business. The structure of the transaction fee may vary depending on the exchange's strategy, such as not charging fees on trades above $10,000 to encourage large-scale trades.

- Deposit methods - as with brokerage companies, users need to fund their exchange account with capital. Many exchanges allow wire transfers and wire transfers, but few allow credit card top-ups, transfers via PayPal.

- Liquidity - The liquidity of an exchange means both the speed and ease of access to the exchange when converting one asset to another without affecting its price.

- User reviews - visiting various Forexcommunities and reading user reviews is one of the best ways to evaluate which exchange to choose.

5. Choose Trading Platform

In trading, your main working tool will be the trading terminal, such as MetaTrader 4, or MetaTrader 5 or NetTradeX, cTrader, etc.

It is through the trading terminal that you will keep in touch with your broker and issue him orders to buy and sell financial instruments. Don't worry, you won't have to invest a single penny of your money because, firstly, a trading terminal for trading on the Forex market is provided by the broker for free, and secondly, you will take your first steps as a trader on a virtual demo account.

In addition, if you plan to trade not only from your computer, but also use such gadgets as a smartphone or tablet, then take care of installing the appropriate mobile applications. In this case, it will not hurt you to first check with your broker for information about whether he has these same applications available.

Before starting to trade on a real account, a novice Forex trader just needs to try his hand at a demo account. Experienced traders can use these accounts to hone their skills and practice new strategies.

Such an account, in fact, is no different from a real one, except, of course, a deposit (on a demo account, the deposit is virtual). In all other respects, it is similar to a real account. Those. you see on charts and trade real prices in real time.

As a rule, the same set of trading instruments is presented on demo accounts as on real accounts. Another point that distinguishes such an account from a real one may be the speed of order execution. However, most of the time this difference is not noticeable and appears only in moments of high volatility in the market.

Note: Remember that you need to switch to real money trading only after you stop losing your deposit on a demo account and start earning steadily!

6. Choose Forex Trading Strategy

Technical analysis, in our opinion, is the basis of the fundamentals in the work of a trader. Although, of course, knowledge of this type of analysis is not a panacea, but without knowledge of the basics of technical analysis, you should not even try to start trading on Forex.

In a nutshell, the technical analysis of the market is a series of conclusions based on the study of price movements in the past. One of his axioms is the assertion that history tends to repeat itself. Thus, having found the same models of price behavior (patterns) in the past on the price chart, the technical analyst concludes that in the future the price, with a high degree of probability, will behave in exactly the same way.

In addition, an important component of the theoretical basis of technical analysis is the concept of trends. Another of his axioms says that price movement occurs in trends. Moreover, trends of a small order are included in large ones, and those, in turn, are part of even larger trends.

On this axiom, in particular, Alexander Elder's system of three screens is based. He looks at price charts on different timeframes (time periods) in order to assess what part of the larger trend is the price movement that is currently observed on the chart open for trading.

Support and resistance levels are another powerful tool for technical market analysis. On price charts, one can often observe that for a long time the price cannot rise above (or fall below) a certain boundary - a level. This phenomenon is usually associated with the accumulation of pending orders to open large total volumes of transactions.

In other words, the price driven by buyers (sellers), reaching such an accumulation, is faced with an avalanche of orders from sellers (buyers), which push it back. And so on until the accumulation of applications runs out, and after that, the so-called breakdown of the level occurs.

Fundamental analysis is also quite an important discipline in the education of a trader. Although, in my opinion, the role of fundamental analysis when applied to the Forex market is not as important as, for example, when applied to trading on the stock exchange.

Therefore, in Forex, we suggest limiting yourself to the following points: try not to trade at the moment when important fundamental news is released (since the rate fluctuations at this moment are unpredictable) and monitor changes in US and EU interest rates.

In terms of fundamental analysis of the foreign exchange market, it is important for a forex trader to monitor such macroeconomic indicators at the level of individual countries as interest rates, unemployment rates, industrial production levels, the rate of change in inflation, in a word, all those indicators that may affect the change the exchange rate of the national currency of a particular state (included in the analyzed currency pair).

For example, let's consider a hypothetical situation with the USD/JPY currency pair. Suppose that the level of interest rates in the United States will increase, and in Japan, on the contrary, will decrease. This will lead to the fact that it will become more profitable to invest money in the USA (interest rates are higher there). But investments in the Japanese economy, due to a decrease in interest yield, may noticeably decrease. Well, as a result of all this, we can expect an increase in the dollar against the yen, and, consequently, an increase in the quotes of the USD/JPY pair.

An important role is also played by tracking various kinds of news that are not directly related to the economy, but which in the end can have a significant impact on it. For example, natural disasters and man-made disasters of a large scale can cause significant damage to the economy of a particular country and, as a result, affect the exchange rate of its national currency.

Note: You can find all this news, as well as data on the main macroeconomic indicators, in a special trader's calendar.

Based on these two: technical and fundamental analysis, you will need to develop your trading strategy, of course there are many working strategies, there is no need to open the wheel, but adding a few ticks here and there depending on your priorities and nature is unavoidable.

A trading strategy is a set of rules that clearly indicates to a trader when and under what conditions he should open and close his positions.

Having reached this stage, you have already acquired all the necessary information and your knowledge should be enough to build your own trading system. You need a trading system in order to turn trading from a feverish pursuit of currency fluctuations into a calm, respectable occupation that brings regular, stable income.

The trading system requires unquestioning obedience from the trader, but thereby removes most of the psychological burden from him. As we noted earlier for yourself, you must create your own trading system that takes into account all your psychological characteristics (your risk tolerance, attitude to losses, level of activity in trading, etc.).

The task of the trading system is not only to indicate the entry point to the position. The choice of the moment of opening a position is, of course, an important component of the process of successful trading, which is difficult to overestimate. But no less important is the question of exactly when to exit the trade - to close the position.

An important advantage of system trading is the possibility of its automation. When the whole trading process is laid out, as they say, piece by piece and written in the form of a certain set of rules, it is easy to transfer it to a programming language understandable to a trading robot. You can automate both the entire trading process as a whole, and its individual components.

Although the system requires the trader to strictly obey all the rules prescribed in it, these rules themselves are not immutable. The fact is that any, even the most advanced and optimized trading system, requires some refinement over time. Everything in this world flows, everything changes, and financial markets are no exception to this rule.

We will present you the most popular ones, the rest is up to you.

Moving Averages

The strategy is applicable for any currency pairs, for its implementation, the trader needs to plot two moving averages on the chart: one is fast, with a short period, which will be close to the price and react to its small changes, and the second is slow, with a large time period.

The essence of the strategy lies in the type of intersection of these moving averages. When the fast one crosses the slow one from the bottom up, it is necessary to buy, and when it crosses from the top down, it is necessary to sell.

Wedge

The strategy is intraday and can be used for any currency pairs on any timeframes. The appearance of a wedge pattern on the chart usually indicates a change in trend, so most often it forms at the bottom or at the top of the chart. The wedge is represented by a series of Japanese candlesticks, the resistance and support lines of which are narrowing, and the narrowing of the figure coincides with the direction of the trend.

An ascending wedge is formed at the market high, and a downward breakdown indicates a change in the trend to a decrease, and the formation of a descending wedge with a breakout upward indicates a change in the trend to an increase.

Scalping

The strategy is scalping and is suitable for any currency pair. The best time to apply the strategy is the opening of trading in New York and London. A buy or sell trade should be opened when the price crosses all the EMAs (exponential moving averages) of the chart.

Moreover, if the price crosses the EMA from the bottom up, then this is a signal to make a purchase. Take profit (automatic completion of the transaction) is recommended to be left no higher than 10 points, as the price may reverse. Transfer to breakeven is carried out immediately after the price has moved away from the opened transaction.

Three Candles

Another scalping strategy with a minute timeframe. According to this strategy, at the close of the next candle, you need to pay attention to the last three. The size of the body of the last candle must be larger than the size of the bodies of the previous two.

The penultimate candlestick should be bearish, and the last candlestick should be bullish, i.e. its closing price should be higher. If these conditions are met, at the opening of the next candle, you can open a buy deal. To sell, the closing price of the last candle must be lower than the close of the penultimate one.

Despite the fact that there are many strategies, the best one is the one that is chosen by the trader himself in the course of work, by trial and error. But, so that mistakes do not become fatal, you need not just to try, but to learn, comprehend existing experience, master ready-made strategies and enrich them with your own developments.

7. Know When to Buy and Sell

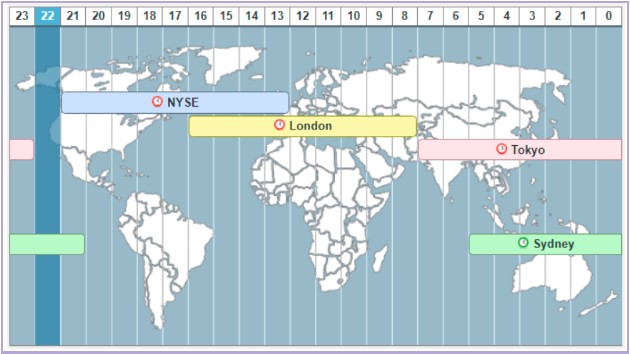

If you choose the best time for trading, the trader will get an advantage - during this period, volatility is at its height and the profit on transactions will be close to the maximum. Developing the right trading schedule is one of the components of success.

The movement of the price of any asset is determined by the ratio of supply and demand. If an imbalance is formed in the direction of demand, the graph begins to grow, in the direction of supply, the value of the asset falls.

The possibility of a sharp imbalance increases during periods when there are large traders on the market (hedge funds, banks). That is why European and American trading sessions look more preferable on Forex. At this time, the maximum number of large traders is present on the market, during these periods most of the intraday trends are formed for the main majors and crosses.

Price changes are also affected by macroeconomic statistics for the largest countries in terms of economics. Important data for the US, EU countries, China, emerging markets. The release time of these statistics is also taken into account in trading.

The time factor is important both in Forex and in the stock market. If stock exchanges work only at certain hours, then with Forex it gets a little more interesting, since the market is open 24/5 and volatility is unevenly distributed throughout the day. Most of the daily volume falls on the opening hours of European and American financial centers, this time period is best suited for trading.

If you suddenly want to lose money, you can try trading during the periods indicated below...

If you really don't want to trade the market during the highest volumes and high volatility, when it's easier to make money, then you have to trade on the days described below.

These will be the most difficult trading days!

FRIDAYS

Fridays are hard to predict. This is a good day for losing profits made during the week.

HOLIDAYS

Banks are closed, which means low trading volume, especially if it is a holiday in the US, China, Germany, England, Switzerland and Japan (these countries have more trading volume than others). On holidays, there are more chances to lose part of the deposit than to increase it, so it’s better to “sit on the fence” at this time.

NEWS

No one can predict where the market will move after the release of news, especially important news. The price at this moment is like a pendulum and is completely unpredictable. You can, of course, try to guess the direction of the price and get a good profit. But this is a game of roulette. But you, we hope, do not play Forex, but earn. The most significant news, as a rule, are marked in calendars as "especially important".

These include interest rate data, unemployment rate, trade balance, consumer confidence index, GDP data and some others. The main currency in Forex is the US dollar, therefore, it is natural that it is the news of the US economy that has the greatest impact on currency movements. It is better for a beginner to refrain from trading an hour and a half before the news release and after. In order not to miss the release of important news, you can install the news indicator directly on the chart. How to set the read indicator.

Bottom Line on How to Trade Forex for Beginners

For novice traders who want to succeed in the foreign exchange market, there are a large number of rules to follow. To date, only a few manage to get a stable profit in the market. Many may think that they are just lucky. However, it is not. They are just ordinary traders like everyone else. It's just that from the very beginning of their trading career, they tried to adhere to important rules. They follow the rules of the "game" under any conditions.

Emotions can become the main enemies of any trader. Most beginners are driven by greed and fear. They can equally negatively affect trading activities. When there are such emotions, they do not make it possible to make rational decisions. In any case, wherever the value of the asset chosen for trading moves, you do not need to listen to your emotions. They will not allow you to use strategies correctly.

Under the influence of emotions, it will be difficult to avoid and analyze your mistakes. A correctly chosen strategy is not a guarantee that every transaction, without exception, will be successful. This must be understood. However, it is able to make the number of successful transactions more than unsuccessful ones. That is why even if it becomes obvious that the transaction will end not in favor of the trader, you should not change it. If you have doubts about a particular strategy, you can always use a demo account, which will allow you to check it in action.

When trading on the foreign exchange market, it is difficult to avoid risks. The largest companies create a hedge fund to minimize them. Traders can use the Stop Loss option. You can measure the distance to it and find out what the losses will be if the value of the trading asset reaches it. No need to risk large sums of real money in the hope of making big profits. Forex trading is available almost every day. For beginners, in order to succeed, it is important to make at least one transaction per day.

You need to trade every day, no matter how many minutes or hours it takes. Thanks to this, beginners gain skills and knowledge, without which it is difficult to succeed. It is recommended to keep a diary where you can record the actions on transactions and then analyze what was done correctly and what can be changed. For trading on the Forex market, beginners are provided with everything they need.

It is only important to take the first step and familiarize yourself with the terminology. Next, choose a suitable broker who will provide the best training program, suitable trading instruments. To start trading, you need to choose a suitable trading platform and open a trading account. Thanks to the rules and strategies, you can achieve excellent results in the world of trading.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.