- Analytics

- Trading News

- Visa: Payment Giant Faces Challenges

Visa: Payment Giant Faces Challenges

Visa Inc. experienced a slight slowdown in payment volume growth during its most recent quarter, leading to a 3% decline in its share price after market close on Tuesday.

While the company overall reported solid financial results, with net income rising to $4.87 billion from $4.16 billion a year earlier, concerns about the pace of recovery in Asia impacted investor sentiment.

Payment Volume and Transactions

Visa's payment volume increased by 7% in the third quarter compared to 8% in the previous quarter. Processed transactions grew by 10%, down from 11% in the previous quarter. Cross-border volume saw a more robust growth of 14% year-over-year.

But, a more detailed analysis revealed a slowdown in overall U.S. volume growth in the first three weeks of July compared to June, with debit spending declining more significantly than credit spending.

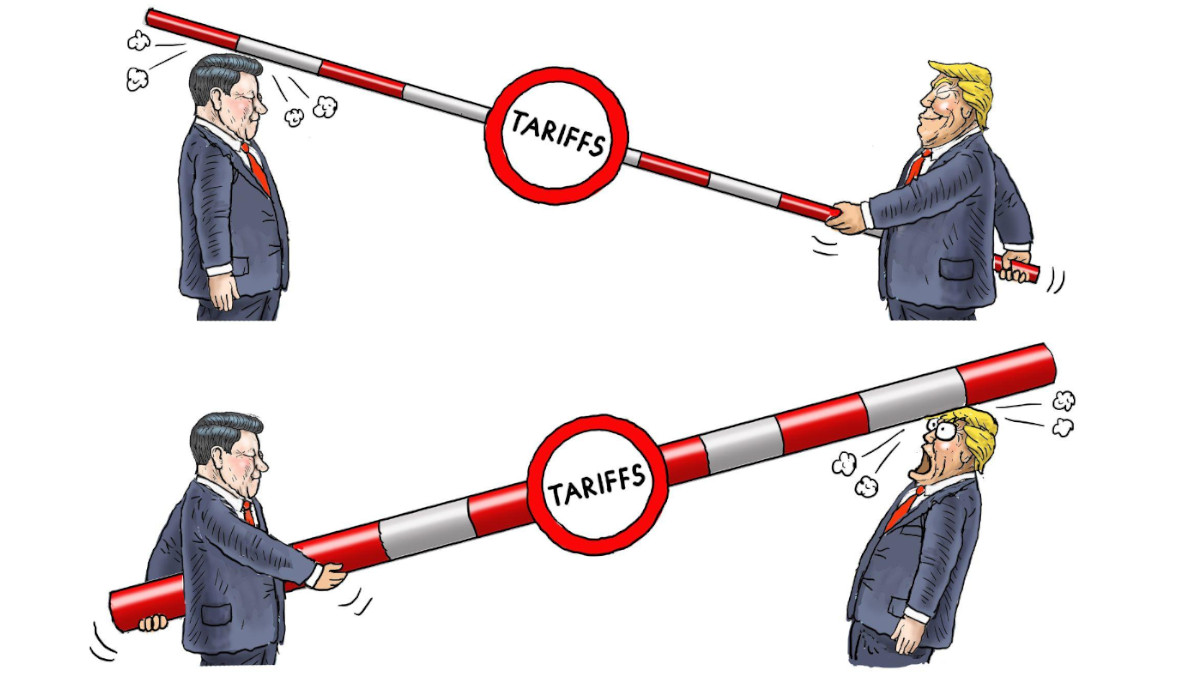

Impact of Asia and Currency Volatility

Visa's slower-than-expected recovery in Asia is due to macroeconomic conditions in China and weak Asian currencies. The significant decline of the Japanese yen, for instance, has reduced Japanese consumers' purchasing power abroad, impacting outbound travel.

Contactless Payments and Future Outlook

Visa is witnessing a rise in contactless payment adoption, particularly in the U.S. where penetration has reached 75% in New York City. The company believes this trend is beneficial as contactless users tend to spend more compared to those using traditional payment methods.

While Visa's overall business is showing stability, the slower-than-expected growth in Asia and the slight miss on revenue expectations have raised concerns among investors.

Visa Stock Analysis

Visa's stock price is currently at a low point within a recent downward trend. It is also trading near its 200-day EMA, which has been a significant level of support since late 2022.

Because of its current position, there is potential for the stock price to increase in the near future. However, there are also indicators suggesting continued downward pressure.

Potential Downward Movement

- Technical Indicators: Two technical indicators, the stochastic oscillator and RSI, are both showing negative trends, which suggests that the stock price may continue to decline.

- Support Levels: If the stock price falls below the 200-day MA and a support trendline from October 2022, the next significant support level is at the lower boundary of a price channel, around 258.35. This level is also supported by a Fibonacci retracement calculation. If this level is breached, the stock price could decline further to 251.78, followed by 245.93.

Potential Upward Movement

- Resistance Levels: If the stock price rises above its 20-day and 50-day EMAs, it may attempt to break through a resistance zone between 275.85 and 277.00.

- Price Targets: If the stock price successfully breaks through the resistance zone, it could continue to rise towards the previous high of 282, and potentially even reach the all-time high of 290.69.

Visa's stock price is currently at a potentially important turning point. While there is a chance for upward movement, the technical indicators suggest that downward pressure may persist.